The latest issue of The TRADE is now available to read online, so with the longer days and warmer weather, why not relax with a cool drink and delve into all the best content from the Spring 2017 issue:

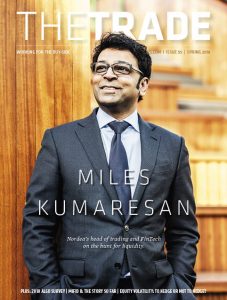

Buy-side cover interview – The hunt for liquidity is one that tests even best in the industry, but technology is evening the odds. Miles Kumaresan, head of trading and FinTech at Nordea Asset Management, discusses how the firm is approaching the problem of liquidity in the bond space and equipping traders with the right tools for the job.

MiFID II: The story so far – For all the talking and preparations, the moment of truth came, went and yet, somehow, continues. MiFID II is an ongoing process and market evolution will take time, but the early signs of how the tale is unfolding so far show that change will be gradual.

Equity volatility: To hedge or not to hedge? – Volatility returned with a bang in February as Vix options trading spiked and investors clamoured to hedge options in the face of a new risk regime, but what decisions are available to investors that are considering hedging, or is it even necessary in the current market?

Moving towards the light – Have trading volumes moved onto lit venues following MiFID II’s restrictions on dark trading and the rise of systematic internalisers? The TRADE investigates.

Fixed income ETFs: One to watch – Fixed income ETFs have witnessed unprecedented growth in recent years, spearheading the rise of the overall ETF market. The TRADE asks why the product is so attractive to investor sand what the future holds for the asset class.

East Asia’s saunter to T+2 – The TRADE examines how those exchanges in East Asia that have not yet made the move to T+2 are preparing to embrace shorter settlement cycles and if the differing approaches signals a shift in regional dynamics.

The 2018 algo trading survey – The arrival of MiFID II is already throwing up new trends when it comes to algorithmic trading according to this year’s results for long-only firms.