What – for you – were the contributing factors behind the successful year that led to this award?

BestX is a technology company that allows clients to assess the quality of their execution in FX, fixed income, equities and crypto markets. The platform operates as a utility to both buy- and sell-side firms and responds to the demand for increased transparency of costs in the wake of an evolving regulatory environment.

BestX has continued to evolve across all asset classes, with each asset class having its own unique analytics layer, computing metrics specific to that asset class, eg: VWAP in equities, WMR in FX, far touch in fixed income. The consistent UI framework and functionality allows for common cost metrics to be brought together across all asset classes, for any multi-asset reporting requirements.

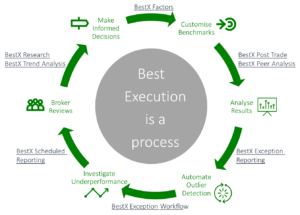

Independent analytics available on BestX allow clients to define, achieve and record a process of best execution. The technology covers the full life cycle of a trade, from pre-trade counterparty selection to post-trade results and automated outlier detection.

BestX clients can codify their best execution process, making more informed decisions to help improve results. The reporting functionality allows efficient broker and asset owner reviews, which can be run on demand or can be automated. comprehensive transaction cost analysis (TCA) is underpinned by representative and independent market data sources, where BestX consumes and stores over one billion price updates per day – which we believe is the broadest and deepest in the TCA space.

Could you outline some of the main achievements and milestones from the year?

BestXecutor:

We’ve had a number of key enhancements, but to highlight a few: The new tool allows clients to see real time analytics at the point of execution. This includes showing within FXConnect the optimal panel size and counterparty mix for each individual RFQ trade, as well as displaying the best performing algo based on the client preferences.

This is an industry first in terms of having two-way communication between an EMS and a TCA provider, taking the communication between EMS and TCA to the next step allowing the feedback loop to close by feeding pre-trade information from BestX back into the EMS and automatically selecting the best performing counterparties based on the client’s specific broker list.

This new functionality enhances the user experience and streamlines clients’ workflows by removing the back and forth currently required between multiple screens and platforms to select the optimal execution method.

Custodial peer pool:

As highlighted in our article “The Good, The Bad and The Ugly of Custodian FX” we have recently released the ability for those clients who have opted in to the community data pool to evaluate their trading performance against peer trades within the custody community data pool. When BestX first launched peer analysis, custodian flow was excluded as most files sent to us lacked timestamps.

As this has now changed for the biggest custodians, we are now sitting on over four million timestamped custodian trades for our clients. Therefore, we are now introducing the data as an additional community data pool (for opted-in clients) which can be filtered and isolated to allow for peer comparison of custody data – whilst excluded from in-house analysis and comparisons. This is to help our clients understand how we are simplifying workflows for oversight and corporate governance, whilst addressing some misconceptions and highlighting existing problems.

Historically, discussing custody data has always been a challenge due to the lack of transparency in this space. BestX has invested time with numerous custodians over the past few years and, because of this, the data quality has dramatically improved resulting in better oversight and control from the buy-side. In the chart below, we can see that both the average spread and standard deviation of the spread improve along with the time.

This is again testament to the fact that BestX has become instrumental in driving transparency and collaboration in the FX industry.

Cost to replace:

Cost to replace:

The cost to replace metric was introduced in our last release to quantify the value add of each bank measured as the cost to cover every time they win an RFQ. This will help easily identify the most valuable counterparties.

Launch of fixed income pre-trade:

Fixed income TCA is one of the most challenging given the varying levels of liquidity, market data and effective benchmarks. BestX fixed income TCA has one of the deepest data sets available ingesting data from ICE, Refinitiv, MarketAxess, IHS Markit and Tradeweb creating a broad coverage across the cash FI universe.

Our new pre-trade module now allows clients to submit a target ISIN code with an intended size and direction and subsequently be able to see an expected cost, liquidity score and the competitive liquidity providers.

In addition, we are now able to produce a list of similar bonds to that target ISIN, which can be configurable by issuer, coupon type, and seniority.

Equity peer analytics

BestX launched an equity peer analysis module to add to our existing offering for FX. This would allow users to benchmark their trading performance against their industry peer or across the group of all BestX clients offering insights into execution quality and understanding areas of improvement.

How do you plan to build on this success?

Innovation and partnership with our clients around our product development agenda remains the cornerstone of BestX. This includes further analytics and functionality in BestXecutor, to enable clients with enhanced analytics around their decision point to execute a trade as an algo or RFQ, enhancements in our fixed income pre-trade to allow further insights into market liquidity and axes, a fixed income peer pool and equity pre-trade. BestX’s mission continues to be to offer an analytics tool to help clients record, define and achieve best execution and to ultimately help create better outcomes for the world’s investors and the people they serve.