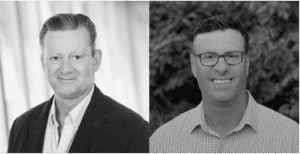

John Orrock has been named head of fixed income outsourced trading at Marex, alongside several other senior appointments in the division.

Orrock takes up the fixed income reins after having served as managing director since February 2022, prior to the spin-off of the outsourced business from Cowen.

Orrock takes up the fixed income reins after having served as managing director since February 2022, prior to the spin-off of the outsourced business from Cowen.

Prior to joining Cowen International in 2022, Orrock was head of emerging markets and outsourcing at Aurel BGC and before that worked as a trader at BlueBay Asset Management for more than 17 years.

He has also held senior roles at Martin International Securities and Tullet & Tokyo Securities.

Read more: Marex hires in ex-Winterflood Securities equities trader

Alongside Orrock’s new role, Ron Catena has been named director, fixed income outsourced trading, joining from JP Morgan Asset Management where he most recently served as executive director, emerging markets fixed income.

Catena has three decades of experience in financial services including a wealth of buy-side trading expertise having previously held senior positions at various firms, including: Vandham Securities, First New York Securities, Securevest Financial Group/GCP, Santander Investment, Donaldson, Lufkin & Jenrette, and Morgan Stanley.

Speaking in an announcement on social media, Catena said: “I am pleased to be a part of the fixed income outsourced trading team at Marex. I look forward to applying my extensive experience to benefit our firm’s clients and collaborate with my new colleagues to further build out our bespoke services.”

Commodities specialist Marex completed its acquisition of TD Cowen’s outsourced trading and prime brokerage business in December last year. The business was rebranded as Marex Prime Services and Market Outsourced Trading, with both becoming part of the Marex Capital Markets business – formed last year following the acquisition of ED&F Man Capital Markets.

News broke of the split with TD in June 2023, reportedly concluding it would be in the best interests of clients if the prime brokerage and outsourced trading business were divested to a partner more “strategically and geographically aligned” to the platform.