Since its implementation in 2018, MiFID II has transformed the regulatory landscape for securities markets, investment intermediaries and trading venues. Bringing in a vast swathe of changes, updates, revisions and requirements, the legislation represented the biggest shake-up to financial regulation in Europe for decades. But it hasn’t all been smooth sailing, with some elements abandoned, and others creating significant increases to compliance costs. Although of crucial importance, the regulation has been subject to criticism from the industry for its complexity and inflexibility, and the authorities have listened to these concerns. In late 2021, the European Commission agreed to a review, proposing a broad set of amendments that could once again up-end the markets, and players are now holding their breath to see the final outcome. In light of the importance of these updates, The TRADE is delighted to present a series of roadshows hosted at some of the top exchanges in Europe, with a view to exploring the complexities, challenges, and potential consequences of these new revisions. Bringing together leading industry stakeholders, market participants, regulators and MiFID II experts to discuss the implications, each roadshow will be tailored to its host country: exploring exactly what the new MiFID II might look like and what it would mean for them.

Join us as we dive deep into the regulation, drive understanding of the updates forward, and develop a roadmap for the industry to deal with their impact.

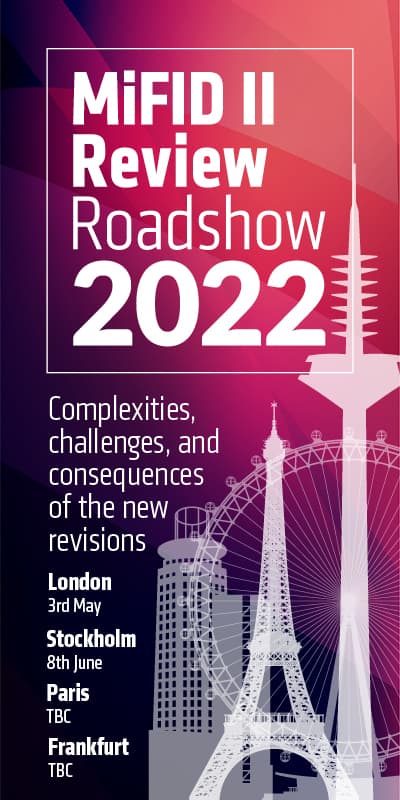

- London Stock Exchange: 3 May 2022

- Stockholm Stock Exchange: 8 June 2022

- Paris Euronext: tbc

- Frankfurt: tbc