What has driven the markets to the cost saving measures we see today?

Rodriguez: Looking at the overall market environment, volumes are at multi-decade lows, with the exception of APAC, which drives a strong need for market participants to keep finding new ways to do more with less. It fuels an ongoing pressure in the marketplace to review and reduce the operational costs of trading. Both the buy- and sell-side are being impacted, whether it relates to market data, FIX connectivity, or rising exchange fees. Additionally, with the US move to T+1 happening this May, you have to wonder when that change will be coming across to Europe next, delivering further impacts to global asset managers. Adjusting for that will bring another set of associated costs along with it.

Europe: Record lows

Source: Bloomberg

US: Off a record high hit in 2022. Current turnover is 3X 2013 levels.

Source: Bloomberg

In terms of the trading day, the Close is the most expensive time to trade because the primary exchanges capture the vast majority of this flow and hold the closing price benchmark. Incredibly, since 2016, the Closing Auction in EMEA has grown, from about 15% of a total day’s volume in the region, to more than 30% currently.

The pricing structure from the incumbents makes it even more expensive. So, the more the Closing Auction grows, the more expensive it is to trade in that way. In turn, that means participants are thinking about alternatives, where perhaps they can internalise that flow or use other venues.

Proportional Volume on the Close: Developed Europe vs Emerging Europe

Source: MSCI, Instinet

With our microstructure analysis team, we also strive to keep clients closely informed on auction trends and execution costs by generating monthly publications focused on these areas; The Global Auction Monitor and The Global Execution Cost Monitor.

The Global Auction Monitor is a monthly global microstructure analysis report that focuses exclusively on auction trends for each country in the MSCI ACWI index. More simply, it is an interactive tool that helps quantify auction volume trends across global markets. The Global Execution Cost Monitor tracks liquidity, bid/offer spreads, volatility and estimated market impact for each country in MSCI ACWI.

Whelan: If you pull the lens out and think about what the market has been like, for both the sell- and buy-side, you have a higher interest rate environment, you have geopolitical concerns, and you have regulatory hurdles. Those have all hurt revenue streams for the banks, in areas for instance, like M&A. When revenues are under pressure, it’s natural for businesses to look more closely at their costs. The equity trading environment is just one area that has been challenging on the revenue side. We are also seeing firms on the brokerage side being more selective about their own areas of focus and there are signs of retrenchment from some around what capabilities they are able, or willing, to invest in. Ultimately, this can lead to impacts on the innovation space too.

From a vendor perspective, outside of direct regulatory costs, we also see standards increasing around how a business and its technology should operate. This is most evident in the increasingly formalised process of vendor reviews, where the bar keeps moving higher on the due diligence applied to topics like BCP, disaster recovery, data use, and information security. There are costs that come along with all of that.

How is this impacting technology use/automation levels/algo usage on the buy- and sell-side?

Rodriguez: Cost is a big barrier to entry. It’s multiple tens of millions of dollars yearly to invest in a technology platform, an algo stack, skilled personnel, and quant know how. Against the backdrop of challenging market volumes, you might get to a scenario where smart order routing methodology and logic is adjusted to re-calibrate and account for cheaper options. It makes you think about what that does in terms of impacts on best execution outcomes. Recently, we have seen more brokers looking at delivering on internalisation, seeing how they can internalise their flow. It could be through central risk books, or systematic internalisers (SIs), or a crossing mechanism. Some of the bulge bracket firms facilitate order flow from balance sheets, via their SIs or central risk books. We’re seeing more and more of that and many are going down the path quite aggressively.

In a best execution environment, there are a lot of algo broker performance evaluations conducted, both on the buy- and sell-side. Therefore, an additional investment requirement has to be made in quantitative staff that can help support that business. Sell-side firms have historically always provided execution consulting and quantitative input and services to clients. More recently however, the trend has been for buy-side firms to employ their own people that help them evaluate their brokers and the quality of execution provided. These individuals help in the broker evaluation process, examining how they interact with the market and how they perform. This all brings cost onto the business and the more complex it becomes, the more the requirement grows to have specialists in those fields.

Whelan: With the buy-side, automation is the obvious enabler for doing more with less and keeping costs of the trading desk low. Over the past ten years or so, the level of sophistication has grown among the bigger buy-side firms, which were first to begin down the automation path. But, we see that smaller and mid-size firms are continuing to adopt automation too, a first time for some. In terms of cost for the sell-side, we deal with a lot of RFP’s where management is taking stock of the different platforms they have. A lot goes into those conversations, outside of cost, in this environment. In some instances, when a business is doing a broader review of their capabilities and operations it can lead to significant changes in their business model, with that, new technology requirements often follow. In times of cost saving, we find that businesses are a bit more open to discussions around vendor selection and assessing the wider marketplace. It drives more energy around the review process.

How is it impacting the way the buy- and sell-side interact with one another?

Rodriguez: On the sell-side in particular, “juniorisation” of coverage staff is a factor impacting interactions with the buy-side. Being able to make new hires is a good thing but it can have some unintended impacts on the existing relationship and interaction too. Concentration of broker lists is another factor; Is it healthy for the market to only have very similar counterparties? Since there is always discussion about the positive impact diversity has on other aspects of our lives and the general well-being of the ecosystem, perhaps we should therefore apply a similar mentality towards maintaining a diverse landscape in capital markets.

Potentially, rising costs can also have detrimental impacts on innovation and investments in growth. It could make the difference in whether a firm invests in things like AI or ML. If all a firm can manage to do is satisfy regulatory and risk requirements but not innovate and stay relevant, then they could potentially find themselves becoming obsolete very quickly. That ability to remain relevant is the big challenge.

How is this driving trends such as outsourcing? In which areas are clients most keen to outsource and why?

Rodriguez: In some scenarios, firms have come to us saying that they need to decide whether or not to invest in building and maintaining a platform or look at third party solutions, which is where a firm like Instinet comes into its own. It’s about having consultative, open and frank conversations with clients and finding out what benefits of scale exist. We’ve been the beneficiary of many of those types of discussions.

It’s challenging for clients because of the costs of maintaining the business. Our Agency Clearing and Settlement Services offering actually came about as we were exploring ways of reducing our own costs as a firm. Now we extend the service to our clients too, as a way to help them reduce their cost, which is a concrete example of the benefits of scale.

Whelan: With regard to outsourcing, frequently when you evaluate the buy versus build trade off, it’s the value-add portions of a business that are more likely to be insourced with technology, whereas the less critical portions of the business and their supporting technologies tend to be outsourced. For instance, a research provider may outsource their algorithmic platform. A regional broker dealer may build their own algorithms for their local markets where they have scale and market share, but outsource the rest of the globe.

Preparing for the implementation of T+1 in the US, has posed another great cost for the street. It’s been a catalyst for many of the outsourcing discussions we’re having with clients. We’ve been encouraging firms to use this time to automate any of their manual pre-/post-trade processes that could delay their T+1 settlement. At Instinet, we already process thousands of transactions daily with T+1, and even T+0, settlement cycles per client requests. Midway, our proprietary middle office system, is geared for it and we are offering it on a white-labelled basis for brokers to manage allocation processes and connections to CTM, FIX, etc. It’s an example of how we are taking the robust tools we use internally to run our own business and making them available outwardly.

The current cost backdrop forces the rationalisation of business models or at the least, some reflection on how you run your business. Some firms might retrench to some extent For example, if you have previously been expanding into new areas, you might be keeping the focus on your primary markets now. There are some business models where a firm wants to be all things to all people, but I think there are plenty of others out there that say, “We are choosing to be really great, just at these certain things – our bread and butter – and we’ll either outsource or do away with some of the other parts.” More firms are looking to have those sorts of discussions with us and we can provide a broad range of solutions from OMS/EMS through to clearing and settlement, or just the aspects they need. It’s about providing a broad holistic offering.

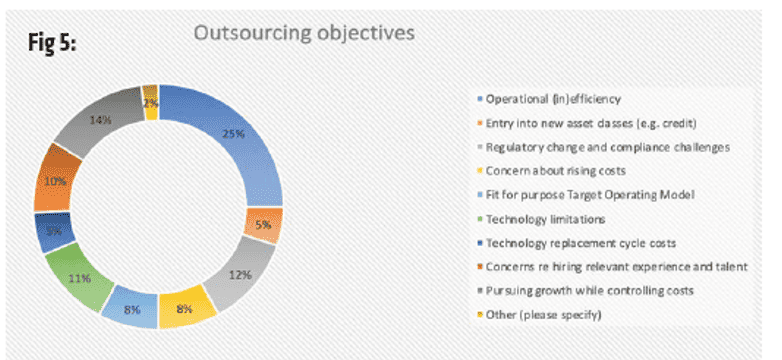

Main reasons for outsourcing

Source: The TRADE, 2023 Outsourced Trading Handbook

What role is cost saving having on consolidation and the provider landscape and what impact is this having on competition?

Rodriguez: We’ve seen a lot of consolidation recently, whether it happens because a firm is struggling or because the acquirer sees an opportunity to add to their own toolkit and service offering. The point is, if this continues over time, it could potentially reduce competition and the number of service providers that the investment community can choose from, which is not necessarily a good outcome for the market at large. The question is, what makes certain firms succeed? Those that succeed tend to have scale and diversification of revenue streams. Breaking through is tough so you need to provide high quality execution, service, access to liquidity, find your niche, and all the other things that come with that; those that don’t, will find it harder to breakthrough. It’s the market dynamic, it’s competition, and in essence, it’s the nature of capitalism. You could call it ‘Darwinism in action’.

Whelan: Speaking from the OMS/EMS point of view, clients have a degree of angst around consolidation as it can prove disruptive to the relationship if it affects services levels, commercial expectations, and key personnel. We have seen consolidation create a catalyst for reviewing the incumbent and opening the door to competition.

Our Instinet Technology Solutions (ITS) business model is about looking in the mirror and saying, “We have a cost base that largely exists to run our global execution business at scale and the costs associated with coming out of the gates every year for it are growing – across regulatory changes, exchange mandated changes, and general R&D so, let’s identify ways we can introduce revenue streams by offering the optimal tools we’ve been using for our own internal consumption to run that business and put them in the hands of our clients to help them perform.” In that light, we are making meaningful investments year in and year out.